castanyes blaves

Random ramblings about some random stuff, and things; but more stuff than things -- all in a mesmerizing and kaleidoscopic soapbox-like flow of words.11/30/2008

Proudly born and raised in Igualada, or not so much sometimes...

Crisi industrial a l'Anoia - Televisió de Catalunya

Crisi industrial a l'Anoia

La comarca de l'Anoia no aixeca el cap i registra una de les taxes d'atur més altes a Catalunya. Sobrepassa el 15% de la població, arriba a 7.500 parats. Actualment, hi ha en marxa molts expedients temporals i indefinits que afecten prop de 900 persones més. La preocupació s'ha traduït avui en manifestació als carrers d'Igualada.

NYTProf by Tim Bunce

11/24/2008

Solar everywhere

UK Pre-Budget Report day

BBC NEWS | Business | Q&A: Pre-Budget Report

What is the pre-Budget report?

Published each autumn, the pre-Budget report is the Treasury's chance to explain in advance the measures likely to be presented in the full budget the following spring, and to update its economic and budget forecasts.

11/19/2008

New Plant Research Centre in Cambridge, UK

Gift funds plant research centre

Botanic garden

The new building with be in an area of the Botanic Garden.

An £82m donation is to help pay for a new research laboratory for the study of plant development at the University of Cambridge

11/18/2008

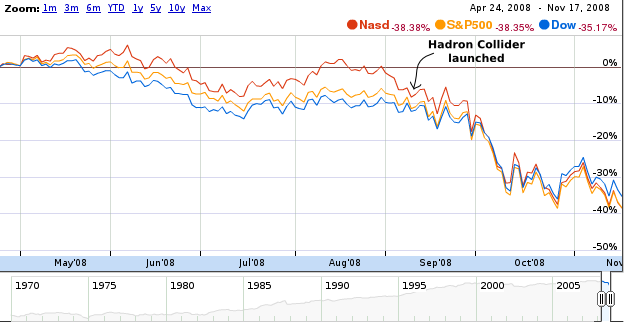

Coincidence? :-)

Coincidence?

11/17/2008

Supercomputing? It's a Linux game

Operating system Family share for 11/2008

In addition to the table below, you can view the visual charts using the TOP500 charts page. A direct link to the charts is also available.

Operating system Family Count Share % Rmax Sum (GF) Rpeak Sum (GF) Processor Sum Linux 439 87.80 % 13341108 20822363 2104191

Windows 5 1.00 % 328114 429555 54144

Unix 23 4.60 % 881289 1198012 85376

BSD Based 1 0.20 % 35860 40960 5120

Mixed 31 6.20 % 2356048 2933610 869676

Mac OS 1 0.20 % 16180 24576 3072

Totals 500 100% 16958600.19 25449076.20 3121579

Adobe 64bit Flash for Linux is here

Over on the Adobe Labs web-site they have released an alpha version of Flash Player 10 that's targeted at Linux x86_64. This 64-bit Flash plug-in works without the NSPlugin wrapper and will "just work" with your 64-bit web browser. The release notes for the 64-bit Linux edition can be read here.

Will Sun be next to improve the 64-bit Linux user-land by releasing an official 64-bit version of its Java plug-in? Let's hope.

11/10/2008

More Open Source graphics acceleration work

In late August, internally at AMD they had their first hardware-accelerated GL triangles on the RV770 GPU using the open-source stack. AMD's Alex Deucher was foregoing XDS 2008 at the Edinburgh Zoo with the celebrating to prepare this RV770 code for release, but unfortunately this code still has yet to surface.

Though by the looks of it, once this R600/700 code is released, it will hopefully be in a pretty usable state to end-users. Perhaps a nice Christmas gift from AMD?

Matthew's comments on user space

Userspace indicates what state it wants to go to and the kernel decides what's going to get powered down. This kind of coarse grained approach means that as your hardware setup becomes more complex you hit combinatorial explosion. Expressing all the useful combinations of hardware state simply becomes impractical if all you're exposing is a single variable. What would be more useful is the ability for userland to interact with individual pieces of hardware.

The amusing thing is that in many cases Linux already has this. Take a look at the backlight and LCD class drivers, for instance. They provide a trivial mechanism for userspace to indicate its desires and then modify the device power state. It's true that there are other pieces of hardware that don't currently have interfaces to provide this kind of information. And that's where cooperation with the existing community comes in. We've already successfully fleshed out interfaces for runtime power management for several hardware classes, with the main thing blocking us being a lack of awareness of what the use cases for the remaining classes are. But linux-pm has seen nobody from the Android team, and so we end up with a lump of code solving a problem that shouldn't exist.

Matthew's comments on user space

Userspace indicates what state it wants to go to and the kernel decides what's going to get powered down. This kind of coarse grained approach means that as your hardware setup becomes more complex you hit combinatorial explosion. Expressing all the useful combinations of hardware state simply becomes impractical if all you're exposing is a single variable. What would be more useful is the ability for userland to interact with individual pieces of hardware.

The amusing thing is that in many cases Linux already has this. Take a look at the backlight and LCD class drivers, for instance. They provide a trivial mechanism for userspace to indicate its desires and then modify the device power state. It's true that there are other pieces of hardware that don't currently have interfaces to provide this kind of information. And that's where cooperation with the existing community comes in. We've already successfully fleshed out interfaces for runtime power management for several hardware classes, with the main thing blocking us being a lack of awareness of what the use cases for the remaining classes are. But linux-pm has seen nobody from the Android team, and so we end up with a lump of code solving a problem that shouldn't exist.

11/07/2008

This is too much

11/06/2008

Benchmarks to compare apples to apples

[Phoronix] Mac OS X 10.5 vs. Ubuntu 8.10 Benchmarks

Apple's Mac OS X 10.5.5 "Leopard" had strong performance leads over Canonical's Ubuntu 8.10 "Intrepid Ibex" in the OpenGL performance with the integrated Intel graphics, disk benchmarking, and SQLite database in particular. Ubuntu on the other hand was leading in the compilation and BYTE Unix Benchmark. In the audio/video encoding and PHP XML tests the margins were smaller and no definitive leader had emerged. With the Java environment, Sunflow and Bork were faster in Mac OS X, but the Intrepid Ibex in SciMark 2 attacked the Leopard. These results though were all from an Apple Mac Mini.

11/04/2008

Mark Shuttleworth on capitalism

Mark Shuttleworth » Blog Archive » This is not the end of capitalism

This is not the end of capitalism

Tuesday, November 4th, 2008

Some of the comments on my last post on the economic unwinding of 2008 suggested that people think we are witnessing the end of capitalism and the beginning of a new socialist era.

I certainly hope not.

I think a world without regulated capitalism would be a bleak one indeed. I had the great privilege to spend a year living in Russia in 2001/2002, and the visible evidence of the destruction wrought by central planning was still very much present. We are all ultimately human, with human failings, whether we work for a state planning agency or a private company, and those failings have consequences either way. To think that moving all private enterprise into state hands will somehow create a panacea of efficiency and sustainability is to ignore the stark lessons of the 20th century.

The leaders and decision makers in a centrally-planned economy are just as fallible as those in a capitalist one - they would probably be the same people! But state enterprises lack the forces of evolution that apply in a capitalist economy - state enterprises are rarely if ever allowed to fail. And hence bad ideas are perpetuated indefinitely, and an economy becomes dysfunctional to the point of systemic collapse. It is the fact that private enterprises fail which keeps industries vibrant. The tension between the imperative to innovate and the consequences of failure drives capitalist economies to evolve quickly. Despite all of the nasty consequences that we have seen, and those we have yet to see, of capitalism gone wrong, I am still firmly of the view that society must tap into its capitalist strengths if it wants to move forward.

But I chose my words carefully when I said “regulated capitalism”. I used to be a fan of Adam Smith’s invisible hand, and great admirer of Ayn Rand’s vision. Now, I feel differently. Left to it’s own devices, the market will tend to reinforce the position of those who were successful in the past, at the exclusion of those who might create future successes. We see evidence of this all the time. The heavyweights that define an industry tend to do everything in their power to prevent innovation from changing the rules that enrich them.

A classic example of that is the RIAA’s behaviour - in the name of “saving the music industry” they have spent the past ten years desperately trying to keep it in the analog era to save their members, with DRM and morally unjustifiable special-interest lobbying around copyright rules that affect the whole of society.

Similarly, patent rules tend to evolve to suit the companies that hold many patents, rather than the people who might generate the NEXT set of innovative ideas. Of course, the lobbying is dressed up in language that describes it as being “in the interests of innovation”, but at heart it is really aimed at preserving the privileged position of the incumbent.

In South Africa, the incumbent monopoly telco, which was a state enterprise until it was partially privatized in 1996, has systematically delayed, interfered, challenged and obstructed the natural process of deregulation and the creation of a healthy competitive sector. Private interests act in their own interest, by definition, so powerful private interests tend to drive the system in ways that make THEM healthier rather than ways that make society healthier.

Left to their own devices, private companies will tend to gobble one another up, and create monopolies. Those monopolies will then undermine every potential new entrant, using whatever tactics they can dream up, from FUD to lobbying to thuggery.

So, I’m a fan of regulated capitalism.

We need regulation to ensure that society’s broader needs, like environmental sustainability, are met while private companies pursue their profits. We also need regulation to ensure that those who manage national and international infrastructure, whether it’s railways or power stations or financial systems, don’t cook the books in a way that lets them declare fat profits and fatter bonuses while driving those systems into crisis.

But effective regulation is not the same as state management and supervision. I would much rather have private companies managing power stations competitively, than state agencies doing so as part of a complacent government monopoly.

Good regulation is very hard. Over the years I’ve interacted with a few different regulatory authorities, and I sympathise with the problems they encounter.

First, to be an effective regulator, you need superb talent. And for that you need to pay - talent follows the money and the lights, whether we like it or not, so to design a system on other assumptions is to design it for failure. My ideal regulator is an insightful genius working for the common good, but since I’m never likely to meet that person, a practical goal is to encourage regulators to be small but very well funded, with key salaries and performance measures that are just behind the industries they are supposed to regulate. Regulators must be able to be fired - no sense in offering someone a private sector salary and public sector accountability. Unfortunately, most regulators end up going the other way, hiring more and more people of average competence, that they become both expensive and ineffective.

Second, a great regulator needs to be independent. You’re the guy who tells people to stop doing what will hurt society; it’s very hard to do that to your friends. A regulatory job is a lonely job, which is why you hear so many stories of regulators being wined and dined by the industries they regulate only to make sure they don’t look too hard in the back room. A great regulator needs to know a lot about an industry, but be independent of that industry. Again, my ideal is someone who has made a good living in a sector, knows it backwards, can justify their high price, but wants to make a contribution to society.

Third, a great regulator needs to have teeth and muscle. It has been very frustrating for me to watch the South African telecomms regulator get tied up in court by Telkom, and stymied by government department inadequacy. Regulators need to be able to drive things forward, they need to be able to change the way companies behave, and they cannot rely on moral suasion to do so.

And fourth, a regulator has to make very tough decisions about innovation, which amount to venture capital decisions - to make them well, you have to be able to tell the future. For example, when an industry changes, as all industries change, how should the rules evolve? When a new need for society is identified, like the need to address climate change early and systemically, how should the rules evolve? Regulators need to move forward as fast as the industries they regulate, and they need to make decisions about things we don’t yet understand. And even when you regulate, you may not be able to stop an impending crisis. It’s very easy to criticize Greenspan for his light touch regulation on hedge funds and derivatives today, but it’s not at all clear to me that regulation would have made a difference, I think it would simply have moved the shadow global financial system offshore.

So regulation is extremely difficult, but also very much worth investing in if you are trying to run a healthy, vibrant, capitalist society.

Coming back to the original suggestion that sparked this blog - I’m sure we will see a lot of failed capitalists in the future. Hell, I might join their ranks, I wouldn’t be the first ;-). But that doesn’t spell the end of capitalism, only the opportunity to start again - smarter.

This entry was posted on Tuesday, November 4th, 2008 at 1:16 pm and is filed under thoughts. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Archives

200409 200412 200501 200502 200503 200504 200505 200506 200507 200508 200509 200510 200511 200512 200601 200602 200603 200604 200605 200606 200607 200608 200609 200610 200611 200612 200701 200702 200703 200704 200705 200707 200708 200709 200710 200711 200712 200801 200802 200803 200804 200805 200806 200807 200808 200809 200810 200811 200812 200901 200902 200903 200904 200905 200906 200907 200908 200909 200912 201001 201002 201003 201004 201007 201009 201011 201102

Subscribe to Comments [Atom]